Forex License 2025

Our team at will be happy to support you in setting up your company and obtaining a Forex license or a ready-made solution in one of these favourable jurisdictions. With dedicated legal advisors, tax experts and financial accountants to support you, you will find the company establishment and application process simple, hassle-free and transparent.

Contact us today to schedule a personalized consultation and set yourself up for long-term success.

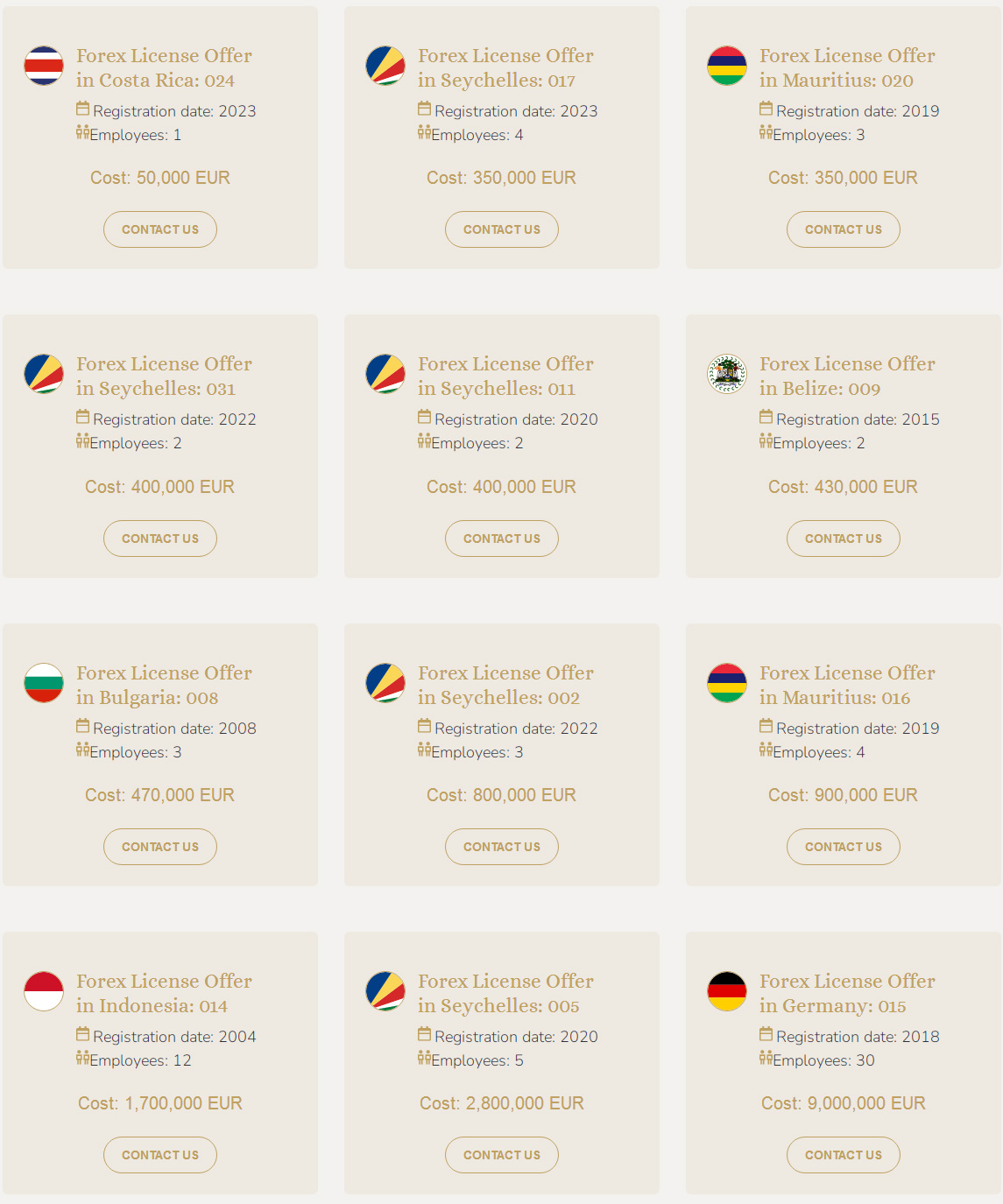

Ready-made company for sale with Forex license

Foreign Exchange Trading License 2025

Foreign exchange market turnover

The Forex market is the largest financial market on the planet, with staggering daily turnover and has experienced significant growth in recent years. In 2019, the Forex market had a daily turnover of $6.6 trillion (about €6.1 trillion), and by April 2023 it had reached $7.6 trillion (about €7 trillion). This extraordinary growth not only highlights the profitability of the market, but also its growing importance in the international financial landscape. To participate legally and safely in this promising market, traders and brokers must understand the regulatory environment and ensure that they offer Forex activities under a legitimate Forex license in the jurisdiction of their target market.

What is a Forex License?

A Forex license, also known as a Forex trading license, is a legal authorization granted by a regulatory body to individuals or companies that wish to engage in activities related to the Forex market. This license is an essential requirement for Forex brokers, Forex trading platforms, and financial institutions that wish to provide Forex services to their clients or engage in currency trading activities themselves.

The main purpose of a forex license is to ensure that forex market participants operate in a regulated and compliant manner and protect the interests of traders and investors. These licenses are issued by governments or financial regulators in various countries and regions and come with a set of rules and standards that license holders must comply with. These regulations typically include requirements related to capital adequacy, protection of customer funds, transparency, fair trading practices, anti-money laundering measures, and risk management.

Advantages of Having a Forex License

If you are planning to start a Forex business, there are many reasons why you should obtain a Forex trading license. Having a Forex license in one or more jurisdictions can increase the legitimacy, credibility and chances of success of your Forex business. Having a Forex license also has the following advantages: easy opening of corporate bank accounts and cooperation with other financial institutions, financial stability, capital protection and greater opportunities for expansion.

Operating within the legal framework as a Forex license holder ensures that your business is run in a transparent and ethical manner and reduces the risk of legal issues or regulatory penalties. Having a Forex license also enhances the credibility and legitimacy of a business in the eyes of key stakeholders. This in turn helps to build trust among clients and partners, a key component of a sustainable Forex business, demonstrating that licensed Forex companies operate in a transparent manner, protecting clients and partners from fraudulent practices and unethical behavior. Needless to say, traders and investors are more likely to choose a licensed Forex broker or platform over non-regulated alternatives.

A Forex license can ensure access to payment processing services, as many payment processors, including banks, electronic payment systems, and other financial institutions, prefer to work with licensed Forex businesses, as they enjoy a higher level of trust and regulatory oversight. This can lead to smoother transactions and access to a wider range of payment methods. It also means that holding a Forex license can significantly simplify the process of opening a corporate bank account for Forex businesses, as many reputable banks require a valid license for businesses operating within regulated industries.

Regulatory authorities generally attach great importance to risk management in the foreign exchange industry, mainly to protect the interests of customers and maintain the overall integrity of the financial market. This regulatory requirement requires offshore foreign exchange license or other relevant license holders to establish and continuously comply with comprehensive risk management procedures. The benefits of risk management policies and procedures are not limited to protecting customers, but also positively affect the financial stability and sustainability of the foreign exchange business itself.

In certain circumstances, Forex businesses that hold a Forex license have access to insurance options that provide additional protection and financial security, which can help improve the overall resilience and stability of the business. They offer insurance coverage for specific risks, such as Errors and Omissions Insurance, which is designed to protect Forex businesses and professionals from claims of negligence, errors or omissions in their professional services, or Client Fund Protection, which is designed to protect client funds in the event of misappropriation or bankruptcy of the business.

Having a Forex license in one jurisdiction makes it easier to expand business to other countries or regions. Some jurisdictions have established bilateral or multilateral agreements, often called "passports", which recognize Forex licenses issued by regulators in other countries. Their purpose is to simplify the expansion of cross-border financial services. Forex businesses that have licenses in jurisdictions with such agreements can benefit from a simplified approval process in other participating countries. This approach is particularly prevalent within the European Union, where there is a comprehensive regulatory framework.

How to Get a Forex License

There are two main options for obtaining a Forex license – applying for a license from scratch and purchasing an existing company with an existing Forex license. Each option has its pros and cons, and you should choose one based on your business goals, resources, timeline, and circumstances.

Applying for a Forex license from scratch allows you to tailor your business structure and align your business operations to your specific goals and target markets. You can ensure that your Forex business complies with all regulatory requirements and standards from day one, minimizing the risk of future compliance issues or regulatory challenges.

On the other hand, applying for a Forex license from scratch can be a long and complicated process involving a lot of paperwork related to company formation and licensing, due diligence and communication with regulators, which can delay the launch of your Forex business. Of course, this option is still beneficial and our legal team can help you get your Forex license easily.

Purchasing an existing company with an existing Forex license can accelerate your market entry. You can begin operations almost immediately, avoiding lengthy application and approval processes. While the purchase price can be considerable, it is still likely to be lower than the combined cost of obtaining a license from scratch, allowing you to devote more resources to business growth and operations.

However, you may have limited flexibility in changing your existing business structure, which may limit your ability to implement specific strategic or operational changes. That being said, our team of experienced attorneys can help you minimize or overcome these obstacles by providing comprehensive support in the process of finding and acquiring an existing Forex company.

How to Apply for a Forex License

Applying for a Forex license is a complex and highly regulated process that varies between jurisdictions. Some jurisdictions offer entry opportunities to startups, while others have more stringent requirements that only established Forex companies can meet. The specific steps and legal requirements can vary greatly depending on the regulator and the country or region you intend to operate in, however, certain general processes are similar in most jurisdictions.

Many jurisdictions require the incorporation of a local company to qualify for a Forex license. The incorporation process can take several weeks and includes the preparation of the required documents. Typically, in order to register, Forex companies are required to meet initial capital requirements, as well as employ a certain number of directors and other key personnel. Many jurisdictions also require a physical presence for the company, including having a local registered office and local employees.

Typically, a newly established company submitting a forex license application will need to meet the following legal requirements:

Have minimum capital, the amount of which varies depending on the regulator in the chosen jurisdiction

Have equipment, technical infrastructure and safety measures that comply with national regulations

Implementing strong Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) procedures, including Customer Due Diligence and Know Your Customer (CDD/KYC)

Establish segregated customer bank accounts to ensure customer funds are separated from operating funds

Company owners, directors and key personnel must meet appropriate criteria to assess their integrity, competence and financial stability

Generally, the following steps should be taken to obtain a Forex license:

Prepare documents required by regulatory authorities

Pay the Forex license application fee and/or annual license fee

Submit the official application form and required documents to the regulatory authority

Attend face-to-face meetings or provide additional information if requested by the regulator

The following documents are usually required:

Articles of Association

A copy of the Articles of Association

A detailed business plan outlining proposed operations, target markets, financial projections, risk management strategies, and compliance procedures

A clear risk management plan

Copies of passports of shareholders, directors and other key personnel of the company

Proof of residential address of the company's shareholders, directors and other key personnel

CVs of the company directors, demonstrating their qualifications and experience in the Forex industry

Criminal record certificates of shareholders, directors and other key personnel

AML/CFT compliance documentation detailing the respective internal policies and procedures

How to buy a ready-made Forex company

Purchasing an existing Forex company, often referred to as an off-the-shelf or shelf Forex company, can be a quicker and more direct way to enter the Forex industry than starting from scratch. If you would like to learn where to find an existing Forex company for sale, please contact our experienced team of attorneys for a personalized consultation. With our extensive experience and active participation in numerous Forex conferences around the world, our team is pleased to be able to provide comprehensive assistance in finding Forex broker licenses and off-the-shelf companies for sale and purchasing the most suitable option with confidence and ease.

You should note that new buyers should meet the following basic requirements:

Have the necessary financial resources to pay annual license fees, maintain minimum capital requirements and meet other financial obligations

The owners, directors and other key personnel of the new company must be fit and proper, including having the qualifications to operate a Forex company

Ensure compliance with all legal and regulatory requirements

Generally, the following steps should be taken to obtain a ready-made foreign exchange company:

Conduct due diligence to assess the suitability of potential shelf companies, including reviewing the company’s financial records and compliance with regulatory requirements

Negotiate the acquisition terms with the seller, including purchase price, payment terms and any other relevant conditions

Drafting of a detailed purchase agreement outlining all terms and conditions of the sale

Arrange payment according to the terms agreed in the purchase agreement

Depending on the jurisdiction and type of forex license, the new buyer may need to seek regulatory approval for change of ownership, which will result in a background check and suitability assessment of the new owner.

Update the company's corporate records, including its articles of incorporation and any necessary regulatory filings

Conduct a thorough compliance review to ensure that the acquired FX company meets all regulatory requirements and standards

New buyers should prepare at least the following documents:

Proof of required capital

Passport copies of the new owners, directors and key personnel

Police clearance certificates for each new owner, director and other key personnel

Proof of residential address of each new owner, director and other key personnel

A clear business plan outlining the new strategy, objectives and operations of the acquired FX company

Detailed planning of a robust risk management program to protect the firm and its clients from market volatility and operational risks

Top Countries for Forex Licenses

When starting or expanding a Forex business, you should keep in mind that obtaining the right license in the right jurisdiction can make all the difference in your path to success. Choosing in which jurisdiction to obtain your Forex broker license or other types of Forex-related licenses is a strategic move that affects your business's reputation, market access, and level of regulatory compliance. When choosing a jurisdiction for your Forex broker license or other related licenses, you should consider factors such as the country's regulatory reputation, business environment, legal requirements, tax implications, barriers to entry, and the specific markets you intend to target.

Since licenses in specific jurisdictions are very popular for some reason among both beginners and established trading platforms who aspire to become Forex brokers, you should also review them more closely. If you decide to carefully examine a jurisdiction that best suits your business goals, please contact our team of attorneys and we will provide you with valuable insights specific to your case.

Cyprus Forex License

Cyprus is the most popular European country among entrepreneurs looking to start a Forex business. Forex businesses in Cyprus are regulated by the reputable Cyprus Securities and Exchange Commission (CySEC), which is known for its strict regulatory standards and alignment with the European Markets in Financial Instruments Directive II (MiFID II). This provides a high level of credibility and trust for Forex license holders in Cyprus and attracts very valuable clients.

As Cyprus is a member of the European Union, one of the most important advantages of a Cyprus Forex license is the ability to take advantage of EU passporting rights, i.e. providing services and operating in other EU member states without having to obtain a separate license in each country. The Cyprus tax system is undoubtedly one of the most competitive in Europe. The corporate income tax rate is only 12.5% and there is no tax at source, which makes Cyprus an attractive jurisdiction for Forex businesses seeking to optimize their tax obligations.

Depending on the scope of your business activities, you can choose from 3 main Cyprus Forex licenses:

Basic License – for investment advice and order execution, or providing investment advice and portfolio management services

Standard (Market Making) License – for routing client orders directly to liquidity pools

A full (proprietary trading) license allows the holder to trade Forex using their own capital, without having to trade for external clients or customers.

The main legal requirements for Cyprus Forex license applicants are as follows:

The company must be registered in Cyprus

Minimum required capital – varies from 50,000 EUR to 730,000 EUR, depending on the license type

License application fee – 3,000 EUR

Annual license fee depends on the Forex company’s annual turnover (0-0.5%)

Has a registered office in Cyprus and is able to support Forex trading activities

Company shareholders, directors and other key personnel must meet the fit and proper standards

Strong internal AML/CFT policies and procedures

The application process usually takes up to 6 months, depending on the quality of the application and other relevant factors. For an additional cost of 25,000 EUR, the application can be fast-tracked to complete the entire process in 3-4 months. Purchasing a ready-made Forex company in Cyprus may be less time-consuming, provided that all legal procedures are handled with the utmost attention to ensure that the acquisition process goes smoothly.

Mauritius Forex License

Mauritius is actually the most popular country in the world to obtain a Forex license. Forex businesses in Mauritius are licensed and regulated by the Mauritius Financial Services Commission (FSC), which has set strict standards to enforce and maintain compliance, transparency and investor protection, providing a safe environment for Forex market participants. As a result, the FSC in Mauritius is recognized by international regulators and organizations, enhancing the credibility of Forex businesses licensed in this jurisdiction.

Mauritius is well known for its ease of doing business and ranks quite favorably in various global indices. The regulator has streamlined regulatory procedures and minimized administrative barriers to conducting forex business from or in the jurisdiction, making Mauritius an attractive destination for forex brokers and related businesses seeking a streamlined licensing process. In addition, Mauritius has no government-enforced exchange controls and has several important tax benefits, including a relatively low corporate tax rate and exemptions from capital gains tax and tax at source.

In Mauritius, the following types of Forex licenses are granted:

Investment Broker License – For businesses operating as Forex brokers

Investment Advisor License – For businesses that provide foreign exchange-related investment advice and consulting services to clients

Global Business License (GBL) – not a specific Forex license, but the holder can still carry out financial activities, including Forex trading

The main legal requirements for Mauritius Forex license applicants are as follows:

The company must be registered in Mauritius

Minimum required capital – varies from 45 MUR (approximately 1 EUR) to 700,000 MUR (approximately 14,000 EUR), depending on the type of license

License application fee – varies from 5,000 MUR (approximately 100 EUR) to 23,000 MUR (approximately 460 EUR), depending on the type of license

Annual license fee – from 57,000 MUR (approximately 1,200 EUR) to 90,000 MUR (approximately 1,800 EUR), depending on the type of license

Have a registered office address in Mauritius for official communications

Shareholders, directors and key personnel must be fit and proper

Internal AML/CFT policies and procedures

Typically, the application process takes 4-8 months, depending on the complexity of the business, the quality of the application submitted, and the workload of the regulatory agency. In order to minimize the application processing time, it is strongly recommended to prepare the application with the help of a legal expert.

Seychelles Forex License

Due to various advantages, Seychelles has also become one of the reputable jurisdictions to obtain a Forex license. The Seychelles Financial Services Authority (FSA) not only issues and regulates licenses for Forex brokerage businesses, but also provides regulatory support, simplifies the navigation of regulatory compliance, and ensures that regulated Forex businesses absorb the latest regulatory changes.

Seychelles offers a flexible regulatory framework for Forex businesses, effectively balancing the relationship between promoting business growth and maintaining strong regulation. The jurisdiction is known for its simplified administrative procedures and transparent regulatory guidelines, which make it easier for Forex licensees to maintain compliance relative to some other jurisdictions. In addition, Seychelles offers a favorable tax environment, where there is no capital gains tax, corporate income tax or source tax, which applies to Forex trading activities conducted by international business companies (IBCs) established in Seychelles.

Seychelles offers the following types of Forex licenses:

A securities broker license allows activities related to foreign exchange trading, foreign exchange brokerage and market making.

An investment adviser license enables a business to provide investment advice

A Company with a Special License (CSL) is a multifunctional license that serves as a license for activities such as a Forex broker license

An International Business Company (IBC) license allows for a flexible structure to conduct a variety of international business activities, including foreign exchange trading

The main legal requirements for Seychelles Forex license applicants are as follows:

The company must be registered in Seychelles

Minimum capital required – 660,000 – 1,300,000 Seychelles Rupees (approximately 47,000 – 93,000 Euros) for a stockbroker license, other types of licenses on a case-by-case basis

License application fee – Determined by the type of license and the scope of Forex trading activities

Annual license fee – determined by the type of license and the services provided by the Forex licensee

All individuals who intend to participate in the management, control or ownership of a Forex company must meet the FSA's appropriate standards.

Complete operational infrastructure

An effective internal AML/CFT policy and a designated AML officer

Comoros Forex License

While some FX startup-friendly jurisdictions are tightening regulations or introducing new regulatory frameworks, Comoros is emerging as the cheapest country to obtain a FX license. The Mwali International Services Agency (MISA) is responsible for issuing and supervising FX operations conducted from Comoros. It remains flexible and adjusts to market conditions and emerging risks rather than being bound by rigid rules.

The Administration currently implements the

Low regulation, with relatively easy-to-meet legal requirements and a fast licensing process, and no need to set up an office in Comoros. License fees and operating costs are much lower than in more mature FX regulatory jurisdictions. Therefore, it is considered the best alternative to SVG and Vanuatu jurisdictions, and the preferred jurisdiction for new FX startups looking for a fast and affordable solution.

In Comoros, a Forex license is formally known as an International Broker License, which authorizes a range of financial activities including, but not limited to, stockbroking, futures trading, contracts for difference (CFDs), and related financial services.

The main legal requirements for Comoros Forex license applicants are as follows:

Register International Business Company (IBC) in Comoros

Minimum capital required – approximately 24,000,000 Comorian francs (approximately 50,000 euros)

License application fee – starting from approximately 1,900,000 Comorian francs (approximately 3,800 euros)

Annual license fee – from approximately 1,200,000 Comorian francs (approximately 2,400 euros)

All company owners and directors must go through a due diligence process

Internal AML/CFT policies and procedures must be established

A Comoros Forex license can be obtained in 2-4 weeks, which is particularly efficient, compared to other jurisdictions. The license is granted for a period specified by the authorities and can be renewed provided the licensee continues to comply with national legislation.

If you are looking to start Forex trading or expand your Forex trading activities and obtain a Forex license, our team will be more than happy to support you in setting up your Forex company and applying for a Forex license. We can also confidently guide you in finding viable Forex licenses for sale and purchasing a proven solution in the shortest possible time.

With dedicated legal advisors, tax experts and financial accountants by your side, you will find the process of starting or expanding your foreign exchange business easy, frictionless and transparent. Contact us now to arrange a personalized consultation and lay the foundation for long-term success.

-

What is the main purpose of a Forex license

The main purpose of a foreign exchange license is to ensure that foreign exchange market participants operate in a standardized and compliant manner and safeguard the interests of traders and investors. -

What are the benefits of having a foreign exchange license for a business?

Holding a Forex license enhances the credibility, trustworthiness and legitimacy of a business. It simplifies the process of opening a business bank account, ensures financial stability, protects client funds, and provides opportunities to expand into multiple markets -

What are the advantages of buying a ready-made licensed Forex company?

Purchasing an existing FX company with a license can speed up market entry and save time and resources compared to starting from scratch -

What are the main factors to consider when choosing a forex license jurisdiction?

When choosing a jurisdiction for your forex license, consider factors such as regulatory reputation, business environment, legal requirements, tax implications and market accessibility. -

What are the key regulatory requirements typically associated with obtaining a Forex license?

Regulatory requirements for obtaining a forex license typically include:

Minimum capital requirements

Personnel suitability and appropriateness standards

Risk management procedures

Anti-money laundering measures

Client funds protection

Adherence to transparency and fair trading practices -

How a Forex License Can Help with Risk Management in the Forex Industry

A forex license generally requires businesses to establish and adhere to a comprehensive risk management program. This helps protect clients and investors, has a positive impact on financial stability, and ensures the sustainability of the forex business. -

What role do regulators play in supervising forex license holders?

Regulators monitor Forex licensees to ensure they comply with industry regulations. In the process, they conduct audits, enforce standards, and may impose penalties or revoke licenses for violations. -

Can companies with a foreign exchange license obtain payment processing services more easily?

Yes, businesses with a Forex license will generally find it easier to obtain payment processing services as many payment processors and banks prefer to work with licensed Forex businesses due to the increased level of trust and regulation. -

How having a Forex license can improve your business’s reputation and credibility

Yes. Having a Forex license signals to clients, partners and investors that the business operates transparently, ethically and protects their interests.

This builds trust and improves the business’s reputation -

Are there any international agreements recognizing Forex licenses in specific jurisdictions?

Some jurisdictions have established bilateral or multilateral agreements, often called “passports”, that recognize forex licenses issued by regulators in other countries.

These agreements simplify the cross-border expansion of financial services -

What are the main difficulties companies face when obtaining a forex license?

Obtaining a Forex license can be a complex and challenging process for businesses due to various regulatory, financial and operational requirements. Some of the main difficulties businesses face when obtaining a Forex license include strict regulatory compliance, capital requirements, complex application procedures, gaps in market knowledge and expertise, and a highly competitive business environment.

CONTACT US

If you need more information or have any compliance-related consultation needs, please feel free to contact us. Our professional team will provide you with the best service.

Hong Kong: Rengang Yongsheng (Hong Kong) Co., Ltd. Mainland: Rengang Yongsheng (Shenzhen) Legal Services Co., Ltd.

Shenzhen: 1106, Building 1, Excellence Century Center, Futian District, Shenzhen (Does not accept business in the Mainland, interviews need to go to the Hong Kong office)

Hong Kong: Rengang Yongsheng, 19th Floor, Yishi Commercial Building, 253-261 Hennessy Road, Wan Chai, Hong Kong

Website: www.jrp-hk.com Hong Kong mobile: 852-92984213 (WhatsApp)

Mobile: +86 15920002080 [Regulatory Compliance Consulting/Hong Kong Lawyer Notarization]

Tel: +86-0755-83017248 Email: 200559081@qq.com