We provide complex services for opening bank accounts in Europe for individuals and businesses. In addition, we are happy to assist with merchant account opening. Our highly skilled team will prepare a detailed quote based on your needs and/or project. Nowadays, financial borders are opening up every day, which makes it possible to open a bank account anywhere in the world completely online. It is very important that the client first understands the procedure for opening a bank account and prepares the required documents, as well as the requirements of the bank or online payment service provider. From our point of view, we can guarantee to make the bank account opening procedure comfortable and stress-free.

Select the type of bank account you want to open

-

Private Bank account

More -

Business Bank account

More -

Merchant Bank account

More -

High-risk account

More -

Offshore account

More -

Crypto business bank account

More -

Bank account in the UK

More -

Bank account in Lithuania

More -

Bank account in Estonia

More -

Bank account in Switzerland

More -

Bank account in Germany

More -

Bank account in Poland

More -

Bank account in the Netherlands

More -

Bank account in Luxembourg

More -

Bank account in Austria

More -

Bank account in Cyprus

More -

Bank account in Gibraltar

More -

Bank account in the Czech Republic

More -

Bank account in Malta

More -

Bank account in Dubai

More -

Bank account in Puerto Rico

More -

Bank account in Singapore

More

FAQ on Pre-approval for Opening a European Corporate Bank Account

Why do I need a pre-approval service when opening a bank account in Europe?

Under pressure from central banks and other global banking regulators, and driven by laws and global de-offshore movement, banks have now developed stricter compliance procedures and begun to closely monitor potential non-resident customers and their businesses.

There are a number of reasons why your company may be denied a bank account in Europe, including:

Type of company activity

Nationality of the beneficiary

Partner and Customer Locations

The company's sources of financing

These are crucial considerations for anyone looking to open a bank account in Europe.

To avoid possible rejections when trying to open a bank account in Europe, it is recommended to choose one or more banks that are familiar with your profile. Our international banking consultants have been analyzing European banking services every day for the past eight years to help clients find the right banking solution, especially for those who intend to open a bank account in Europe as a non-resident.

Opening a bank account in Europe on your own can be challenging, requiring a lot of time and effort to fill out forms and certify documents, and there is still a risk of rejection. This is especially true for individuals and businesses who want to open a bank account in Europe for non-residents.

Getting pre-approval from a bank can significantly reduce the chances of rejection. Regulated One Europe offers a pre-approval service that ensures your business model meets the requirements of the chosen bank, taking into account the country of residence of the beneficiary. This service is essential for those who want to simplify the process of opening a bank account in Europe.

What is non-resident bank account pre-approval?

Pre-approval is a unique opportunity to obtain prior consent or rejection from a bank carefully selected by our experts. The process is designed to consider your complete document package for opening a corporate account in Europe, especially tailored for non-residents.

In this case, whether the bank's decision is positive or negative, it is in your favor. If you receive pre-approval, you will be able to start preparing the necessary documents required to open a bank account. It is important to note that pre-approval does not guarantee that the account will be opened, as the bank's compliance department will make the final decision after reviewing the complete set of company documents. However, your chances increase significantly because the bank has pre-approved your business model and information about you as a beneficiary.

In case of rejection, you can consider other European banks suggested by our experts. This approach saves you time and money waiting for the bank to complete the review process, certification and sending the bank a new set of your company's documents. Document review may take more than a month, and the validity of your certified documents may expire within three months from the date of issuance.

How much does the pre-approval service cost?

The fee charged by Regulated European Bank for the pre-approval service is €2,000 for corporate accounts and €500 for individual non-resident accounts. The fee for the pre-approval service will be individually calculated by the advisor based on the requirements of the compliance department of the selected bank. The basic pre-approval fee includes the service of providing advice on the most suitable bank.

If you are rejected by all banks selected for you (perhaps because your company belongs to high-risk activities), the amount paid is non-refundable. It is important to note here that you can be assured of our complete transparency. We neither mislead our clients nor promise things that are obviously impossible to achieve. We will not offer you a bank to submit a pre-approval application if we are sure in advance that you will be rejected. In addition, if opening an account in any bank is definitely impossible, the pre-approval service will not be available to you. In this case, the reputation of our company and your loyalty are our top priority.

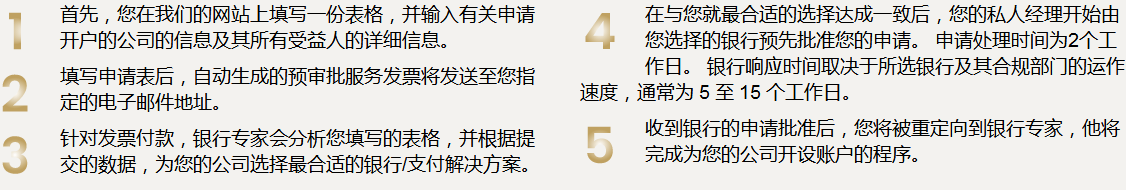

5-step process for providing pre-approval services

Who recommends using pre-approval service?

Our company recommends using the pre-approval service for companies that are considered by banks to be high-risk activities. Keep in mind that most banks are not interested in providing services to such clients and choosing the right bank and opening an account for your company will require a lot of effort and time. It is recommended to use and pay for the pre-approval service for companies engaged in the following activities:

Cryptocurrency trading and related transactions

Gambling (online casinos/betting/poker rooms, etc.)

Adult Industry

Trading activities (foreign exchange/securities trading/binary options)

Precious metals/gemstones trading

Investment activities

Large cash transactions

Businesses related to advanced technology (including IT business)

Using and paying for the pre-approval service is also recommended for company CEOs and individuals who, despite their understandable business model or income type for banks, value their time and money. Such customers usually want to ensure that they are a desirable customer in their chosen bank before proceeding with account opening, preparing/certifying/sending the company’s full suite of documents, and paying in full for the account opening service.

The use and payment pre-approval service is useful if you have already chosen a bank yourself and want to first check whether you can open an account in the bank of your choice. Since the procedures for opening a bank account in Europe are quite similar, this service is also available for banks that our company does not cooperate with.

What protections does the pre-approval process provide?

Getting pre-approval from a bank does not mean that the account will be opened 100%. This important point must be understood and agreed before cooperating. The application for opening an account will be divided into two stages.

In the first stage, your company's business model will be checked by the bank's AML department to ensure that it meets the bank's standards. At this stage, a decision will be made as to whether the bank is willing to provide services to your company and whether the bank is satisfied with your business model. You will be guaranteed to complete this initial stage upon payment of the pre-approval service fee. You cannot be guaranteed a certain decision that the bank's AML officer will make after reviewing your pre-approval application; however, as the bank is initially selected based on your company's business model, you can be guaranteed that the bank will most likely make a positive decision.

In the second stage, your company will be verified by the bank's security services (compliance department). If the bank's AML officer makes a positive decision and all the cooperation requirements of the selected bank are met, starting from the positive pre-approval, the second stage can be carried out. In the second stage, accounts can only be opened for companies and individuals who have submitted completed bank forms and certification documents, deposited (if necessary) the full deposit required for the account opening service with the bank, and met the other requirements of each specific European bank. Whether the bank will make a positive decision at this stage directly depends on the accuracy of the information you provide, as everything else has been agreed in the first stage; obviously, guaranteeing you an account under these conditions would be overconfident, if not misleading, then unacceptable in our company policy. The bank always has the final say.

with What are the advantages of cooperation?

Working with , you can be sure of a detailed review of your company's business model and of fulfilling our obligation to send the relevant request in good faith to the bank that has been selected specifically for you. In addition, you will definitely save time, which without pre-approval and pre-selection of the bank in a professional manner, would be spent on searching for the right bank, filling out the application/forms, preparing the documents, waiting for the bank's decision on whether to open an account (in case of rejection, you will have to start all over again). Even in case of pre-rejection, you will definitely save money, which would otherwise be spent on certifying documents, sending them to the bank and, in case of rejection, re-certifying them and sending them to another bank, since the validity period of the previously certified set of documents will expire (three months from the date of receipt).

Important final points

The pre-approval service is only available for opening current bank accounts (personal and corporate).

The information specified in the pre-approval form must be accurate and true. Remember that in any case, the bank has the right to request additional supporting documents both during the account opening phase and during the operation.

It is important to adhere to the information provided in the pre-approval form. If, during the second stage of account opening, the compliance department discovers inaccurate data, the risk of account opening being rejected increases and you will have to re-select a bank and agree on a revised business model, resulting in additional monetary and time costs.

Open a European bank account online for non-residents

Thanks to the digitization of banking services, it is becoming increasingly easier for non-residents to open a bank account in Europe. This provides important opportunities for international entrepreneurs and individuals who seek to take advantage of Europe's stable financial system without having to travel to the country in person.

Advantages of opening an online account in Europe for non-residents

Access to a stable financial system: European banks are known for their reliability and offer a wide range of financial products, from rescue accounts to investment options.

Improve business operations: Having a European bank account makes it easier to conduct transactions in Euros, pay local suppliers and receive payments from EU customers.

Tax and legal advantages: Many European countries offer tax incentives to foreign investors and entrepreneurs, which makes opening an account there more attractive.

How to open an online bank account in Europe

Explore options: First, it is necessary to determine which banks can open accounts for non-residents online. It is important to evaluate the terms and conditions, fees, available banking products, and minimum account balance requirements.

Documents to prepare: Generally, you will need a passport, proof of residential address (sometimes a foreign address), and proof of source of income or source of funds to open an account. Many banks will also require you to complete a tax residency questionnaire.

Registration and Verification: The process involves filling out an online form on the bank's website, uploading required documents, and completing an identity verification procedure (which may include a video call).

Account Activation: Once the documents are verified and the application is approved, the bank will open the account. In some cases, a down payment may be required.

Possible risks and challenges

Language barriers: Not all European banks offer information or customer service in English.

Regulatory requirements: European banks strictly adhere toKYC and AML regulations, which can complicate the process for non-residents without a clear financial history.

Bank fees: Account maintenance, transaction fees, or currency conversion fees may be higher than expected.

Conclusion: Opening an online bank account in Europe for non-residents has many advantages, especially for those seeking financial stability and international business expansion. However, the process requires careful preparation and knowledge of local banking rules and regulations. It is recommended to engage the services of a professional advisor to ensure compliance with all requirements and minimize potential risks.

Open an online banking account in Europe

In today’s digital economy, the ability to open a bank account online offers significant advantages to international businesses and individuals. Europe, with its well-developed financial system and diverse banking products, offers a wide range of online account opening opportunities, making it easier to access financial services without having to travel to the country in person.

Advantages of opening a bank account online in Europe

Ease of access: Opening an account online allows customers to manage financial transactions from anywhere in the world, which is especially important for those who travel frequently or conduct business internationally.

Fast and Efficient: The online process can significantly speed up and simplify banking transactions, reducing the time it takes to open an account from weeks to days or even hours.

Minimize costs: By not having to go to the bank in person, you can reduce associated costs, such as travel costs or time costs.

Access to a wide range of services: Many European banks offer a wide range of financial products online, including multi-currency accounts, investment and savings products, and payment management facilities.

Online account opening process

Research and choose a bank: The first step is to choose a suitable bank that offers online account opening services. It is important to consider the bank's reputation, terms of service, available products, and user interface.

Apply: Most banks require you to fill out an online form that includes personal details, information about your financial activities, and proof of identity.

Documents: You’ll need to provide a scanned copy or photo of your passport, proof of residential address (such as a utility bill), and possibly a statement of income or source of funds.

Verification and Approval: The bank will verify the documents provided and may ask for more information or a video call to complete the KYC (Know Your Customer) process.

Requirements and limitations

KYC and AML regulations: European banks strictly enforce anti-money laundering regulations, requiring thorough vetting of all new customers.

Language barriers: Despite their international nature, some banks may only offer services and support in certain languages.

Bank fees: Some banks may charge fees for opening an account, maintaining an account, or transferring money internationally.

Conclusion: Opening an online banking account in Europe is a great solution for those seeking convenient access to high-quality financial services. The process offers significant advantages in terms of convenience, speed, and cost. However, potential customers should exercise caution when choosing a bank and be prepared for a rigorous vetting process.

-

Can I open a bank account online?

Many banks offer online account opening services. Please check with the specific bank you are interested in to learn about its online application process. -

Is there an age requirement to open a bank account?

Most banks require individuals to be at least 18 years old to open an account independently. For minors, you can choose to set up a joint account with your parents or guardians. -

Is there any fee for opening a bank account?

Some accounts may require a fee, while others are free. Please be sure to check the terms and conditions to understand any fees that may apply. -

How much money do I need to open an account?

Initial deposit requirements vary by bank and account type. Some accounts may have a minimum balance requirement, while others can be opened without an initial deposit. -

Can I open a joint account with someone else?

Yes, many banks allow joint accounts. Both parties will usually need to provide proof of identity and agree on the terms of the account. -

What types of accounts are available?

Common account types include savings accounts, checking accounts, and certificates of deposit (CDs). Some banks may also offer specialty accounts, such as business accounts or money market accounts. -

How long does it take to open a bank account?

The process varies, but in-person applications generally take 20-30 minutes. Online applications may take a week or two to be processed. -

Can I open a bank account if I have bad credit?

Yes, in most cases your credit history will not affect your ability to open a basic checking or savings account. However, some specialized accounts may require a credit check. -

Can I change or upgrade my account later?

Yes, many banks allow you to change or upgrade your account type as your financial needs change. Please contact your bank for specific details on its account modification policy. -

What security measures are in place to protect my account?

Banks use a variety of security measures to protect your account information, including encryption, multi-factor authentication, and suspicious activity monitoring. -

How do I access my account and manage it online?

Most banks offer online banking through their websites or mobile apps, allowing you to check your balances, transfer money, and manage your accounts anytime, anywhere. -

What are the benefits of opening a bank account in Europe?

Opening a bank account in Europe can bring many benefits, such as access to a stable financial system, enhanced security and privacy, and the ability to conduct business across borders. European banks are known for their stability and security, and many offer competitive interest rates and low fees. In addition, having a bank account in Europe can make it easier to manage your finances when traveling or living abroad. -

What documents are required to open a bank account?

The specific documents required to open a bank account in Europe can vary by bank and country. However, in general, you will usually need to provide proof of identity, such as a passport or national ID card, and proof of address, such as a utility bill or bank statement. If you are opening a business bank account, you may also need to provide business documents, such as articles of incorporation or a business license. It is important to check with your bank to understand their specific requirements and prepare accordingly. -

Can you help me open a bank account?

Yes, we can help you open a bank account in Europe. We specialize in helping clients from all over the world find the right bank and navigate the complexities of opening and managing bank accounts in Europe. Our experienced team of professionals can guide you through the process and help you prepare the necessary documentation to ensure a smooth account opening process. Additionally, for clients in high-risk industries such as cryptocurrency or gambling, we can help you find a bank willing to work with you and provide you with the financial solutions you need to succeed. Contact us today to learn more about our services and how we can help you open a bank account in Europe -

What is Non-resident Bank Account Pre-approval?

Pre-approval is a unique opportunity to obtain a preliminary consent or refusal from a bank carefully selected for you by our experts to consider the full set of documents required to open an account for your company.

In this case, you will benefit from it regardless of whether the bank's decision is positive or negative. If you obtain pre-approval, you will be able to start preparing the documents for opening an account. Obviously, pre-approval does not mean that the account will be opened 100%, since the bank's compliance department will make a final decision only after receiving the complete company documents; however, your chances of getting it will increase significantly, since the bank has already approved it after reviewing your business model, taking into account your information as a beneficiary. In case of refusal, you can choose another European bank provided by our experts without wasting time waiting for the completion of the procedure for reviewing your package of documents and spending your money for the bank to certify the company's new set of documents and send them to the bank. The review of the submitted documents may take more than 1 month, so the validity period of your certified documents (3 months from the date of receipt) may expire -

Who should use the PRE-APPROVAL service?

Our company recommends pre-approval services for activities that banks consider high risk. Keep in mind that most banks are not interested in serving such clients and choosing the right bank and opening an account for your company will take a lot of effort and time. It is recommended that companies engaged in the following activities use and pay for pre-approval services:

Cryptocurrency trading and related transactions, gambling (online casinos/betting/poker rooms, etc.), adult industry, trading activities (forex/securities/binary options trading), precious metals/gemstones trading, investment activities, large cash transactions, advanced technology related businesses (including IT businesses

CONTACT US

If you need more information or have any compliance-related consultation needs, please feel free to contact us. Our professional team will provide you with the best service.

Hong Kong: Rengang Yongsheng (Hong Kong) Co., Ltd. Mainland: Rengang Yongsheng (Shenzhen) Legal Services Co., Ltd.

Shenzhen: 1106, Building 1, Excellence Century Center, Futian District, Shenzhen (Does not accept business in the Mainland, interviews need to go to the Hong Kong office)

Hong Kong: Rengang Yongsheng, 19th Floor, Yishi Commercial Building, 253-261 Hennessy Road, Wan Chai, Hong Kong

Website: www.jrp-hk.com Hong Kong mobile: 852-92984213 (WhatsApp)

Mobile: +86 15920002080 [Regulatory Compliance Consulting/Hong Kong Lawyer Notarization]

Tel: +86-0755-83017248 Email: 200559081@qq.com