Please note that average salaries are pre-tax and may vary by industry, region and profession. It is also worth noting that tax legislation is subject to change, so it is advisable to consult a tax expert or accountant for the latest information before making business decisions.

What is the amount of authorized capital of a Lithuanian company?

The authorized capital of a company is the amount of resources provided by the founders or shareholders to ensure the operation of the company upon its incorporation. In Lithuania, as in many other countries, the amount of authorized capital depends on the legal entity form of the company. In this article, we will look at the specifics of the authorized capital of different types of companies in Lithuania, which will help entrepreneurs choose the form that best suits their business.

Limited Liability Company (UAB)

A Limited Liability Company (UAB) is the most popular business form in Lithuania. It provides flexibility in the way of doing business and limited liability of the founders. The minimum amount of authorized capital of a UAB is EUR 2,500. This amount must be paid before the company is registered in the Register of Legal Entities. In addition to cash, the authorized capital can also be provided in kind (property, intellectual property, etc.), the valuation of which must be confirmed by an appraiser.

Stock Co., Ltd. (AB)

A joint stock company is suitable for large enterprises and companies that plan to attract investment by issuing shares. The minimum authorized capital of an AB is EUR 40,000. This capital amount provides greater stability and the confidence of investors and creditors, but also requires a larger initial investment.

Individual Entrepreneur (IP)

No authorized capital is required to register an individual entrepreneur (IP) in Lithuania. This makes the IP form very attractive for small businesses or aspiring entrepreneurs who want to minimize the initial costs of starting a business.

Limited Liability Company (KŪB) and Limited Liability Partnership (TŪB)

In Lithuania, the law on limited liability companies (KŪB) and limited liability partnerships (TŪB) does not stipulate a minimum amount of authorized capital. These company forms allow the founders to independently determine the amount of contributions, thus providing additional flexibility in business planning.

Branches and representative offices of foreign companies

Branches and representative offices of foreign companies in Lithuania also do not have specific authorized capital requirements. Instead, they must comply with the requirements of the parent company and the laws of the country of origin.

Conclusion

The decision to choose the legal entity form and the authorized capital are important decisions when starting a business in Lithuania. These decisions affect the founders’ financial obligations, tax obligations, and degree of liability.

Is it necessary for a Lithuanian company to have local directors?

Lithuanian law sets out general requirements for company directors, but there is no strict rule that they must reside permanently in Lithuania. This means that a director of a Lithuanian company can be a Lithuanian citizen or a foreign citizen, as long as he or she has the authority to manage the company in accordance with Lithuanian law and international agreements.

Directors’ Duties and Liabilities

The directors (or board of directors) of a Lithuanian company are responsible for the day-to-day management of the company, including the implementation of resolutions of shareholders' (or founders') meetings, the maintenance of financial statements, compliance with Lithuanian law, representation of the company's interests in relations with third parties, etc. Directors are also responsible for complying with corporate governance requirements and may be held liable if the law is violated.

Advantages of local directors

While having a local director in Lithuania is not a requirement, it can offer a number of advantages:

Improved interaction with local authorities and banks: Local directors are more familiar with the local business climate, rules and regulations, which can facilitate the process of opening bank accounts and obtaining necessary licenses.

Language and cultural barriers: A local director can facilitate communication with Lithuanian clients, partners, and government agencies.

Representation of interests: In the absence of founders in Lithuania, local directors can act as representatives of the company.

Choices for foreign investors

Foreign investors who are unable or unwilling to appoint local directors may consider the following options:

Use the services of a management company: Many legal and consulting firms in Lithuania offer professional director services, which can be a convenient solution.

Obtaining a residence permit or work permit: Foreign citizens can consider obtaining a residence permit in Lithuania, which also gives them the right to manage a company.

Conclusion

The law provides flexibility on the question of whether a Lithuanian company needs to have local directors, rather than making it a mandatory requirement. In practice, however, having local directors can greatly simplify the company's management and interaction with local structures. Foreign investors should carefully consider the pros and cons and possibly use the services of a local management company to ensure the smooth running of their business in Lithuania.

What are the state fees for company formation in Lithuania?

Incorporating a company in Lithuania is an important step for entrepreneurs looking to expand their business or start a new venture in Europe. Lithuania offers a favorable economic environment, an attractive tax system, and a strategic location within the European Union. However, as with any other jurisdiction, government taxes and fees must be considered when incorporating a Lithuanian company.

Limited Liability Company (UAB)

To establish a limited liability company (UAB), one of the most popular business forms in Lithuania, entrepreneurs need to pay state fees. The amount of the fee may vary depending on the chosen registration method:

Stock Co., Ltd. (AB)

Forming a joint stock company (AB) in Lithuania, which is suitable for larger businesses and companies with multiple investors, also involves the payment of state fees. The fees for AB registration are similar to those for UABs, depending on how the documents are submitted.

Individual Entrepreneur (IP)

The nominal state fee for registering an individual entrepreneur (IP) in Lithuania is low, around 10 EUR, which is also usually the case for IP registrations.

Limited Liability Company (KŪB) and Limited Liability Partnership (TŪB)

For a limited liability company (KŪB) and a limited liability partnership (TŪB), the state fees are similar to those for a UAB and an AB. This is because the registration procedures for these company forms require a similar amount of administrative work.

Branches and representative offices of foreign companies

Branches and representative offices of foreign companies in Lithuania also need to register and also pay a state fee for their establishment. This fee may be higher than for local companies, taking into account the additional verification of foreign documents. The fee may vary, but for the time being it is between 40 and 100 EUR.

Conclusion

When planning to set up a company in Lithuania, it is important to consider not only the business plan and tax aspects, but also the amount of government taxes and fees, which may vary depending on the type of legal entity and the way in which documents are submitted. Payment of state fees is a mandatory part of the registration process and should be done in advance. Entrepreneurs are advised to also consider consulting an expert to ensure that the registration process goes smoothly and complies with all local requirements.

What is the annual cost of maintaining a company in Lithuania?

When considering starting a business in Lithuania, one of the most important aspects for entrepreneurs is to evaluate the annual costs of maintaining the company. This aspect covers a range of costs, from government fees and taxes to accounting costs and office rent. To give entrepreneurs a complete picture, let’s look in detail at the main components of the annual costs of maintaining a company in Lithuania.

State fees and taxes

Government fees and taxes account for a large part of a company's annual costs. In Lithuania, corporate income tax is 15%, which is one of the lowest in the EU. In addition, there are property taxes, value-added tax (21%), employee salary taxes (including social security contributions), etc.

Accounting and Auditing

The size of the company and the volume of business affect the cost of accounting services. For small and medium-sized enterprises in Lithuania, the annual cost of accounting services may vary from a few hundred to several thousand Euros, depending on the complexity and volume of operations. Companies that must undergo an audit should also consider the additional cost of audit services.

Legal Services

Legal support for the business, including advice on labor, tax and corporate law issues, also affects the annual cost of maintaining a company. The cost of legal services varies depending on the complexity of the assignment and the reputation of the law firm.

Office rent

The cost of renting an office space in Lithuania depends on the location, class and size of the office space. In Vilnius and other large cities, the cost of rent will be higher than in smaller cities or suburbs.

Employee salary

Employee wages are one of the main expenses of any company. In Lithuania, the minimum wage is about 730 EUR per month (2023), but the actual labor costs depend on the employee's qualifications and industry.

Other fees

Other expenses include utilities, communications and internet costs, marketing and advertising expenses, insurance, and other operating expenses.

Conclusion

The annual costs of maintaining a company in Lithuania can vary greatly depending on the type and size of business, the chosen industry, and the level of operational activity. It is essential for entrepreneurs to consider all potential costs to adequately plan their budgets and optimize their tax burden. Competent accounting and legal support can help not only to reduce costs but also to mitigate the risks associated with doing business in Lithuania.

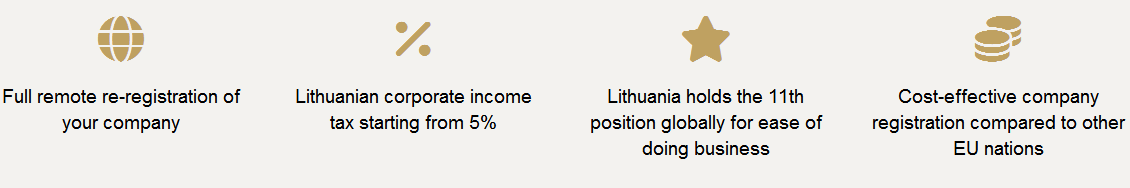

What are the main advantages of setting up a company in Lithuania?

In recent years, the country of Lithuania, located at the crossroads of Eastern and Western Europe, has attracted increasing attention from entrepreneurs and investors from all over the world. The country's membership in the EU and NATO, as well as its thirst for innovation and technological development, have made Lithuania one of the most attractive places to do business. Let's look at the main advantages of setting up a company in Lithuania.

Favorable geographical location

Lithuania’s strategic location in the heart of Europe provides easy access to the markets of the EU, Russia and the Baltic region. This makes Lithuania an ideal location for exporting and importing goods, as well as for expanding into new markets.

Attractive tax system

Lithuania offers one of the most competitive tax systems in Europe. The standard corporate income tax rate is 15%, which is lower than in many EU countries. In addition, there are tax exemptions for small and medium-sized enterprises and companies engaged in certain activities, such as information technology.

Introducing innovation and supporting start-ups

Lithuania actively supports innovative projects and start-ups by providing grants, investments and tax incentives. The country has successfully developed technology parks and business incubators, providing favorable conditions for the development of young companies.

Quality and affordable labor

Lithuania is proud of the high quality of education of its population. Many professionals speak English and other foreign languages, which facilitates communication and business interactions. At the same time, labor costs in Lithuania remain relatively low compared to other EU countries.

Developed infrastructure and digital economy

Lithuania has a well-developed transport and digital infrastructure. The country ranks among the top in Europe in terms of internet speed and broadband coverage. The Lithuanian government’s e-service portal is one of the most advanced, greatly simplifying business interactions between companies and government agencies.

European Business Standard

Lithuanian companies operate in accordance with EU norms and standards, which ensures a high level of trust from partners and customers. This also simplifies the process of exporting goods and services to EU countries.

Supporting foreign investors

The Lithuanian government actively attracts foreign investment by offering various support programs, including assistance in obtaining permits and licenses and advice on choosing a business location.

Conclusion

Lithuania offers many advantages for establishing a company, including a favorable geographical location, an attractive tax system, support for innovation and start-ups, a skilled workforce, a well-developed infrastructure and digital economy, and strict European business standards. All of this makes Lithuania one of the most attractive countries in Europe to do business.

What are the ways to set up a company in Lithuania?

Setting up a company in Lithuania opens the door to the EU market for entrepreneurs and provides a range of economic and tax benefits. The process of company registration in Lithuania can be carried out in a variety of ways, each of which has its own characteristics, advantages and requirements. Let's take a closer look at the main ways of company registration in Lithuania to help entrepreneurs make an informed choice.

Direct company registration

Direct registration is the most common and straightforward way to establish a company. The process involves preparing and submitting the necessary documents to the Lithuanian Legal Entity Registration Center (Register of Legal Entities). This will require corporate documents, proof of authorized capital, details of directors and founders, and the company's registered address.

Registered through notarization

This method implies the submission of a personal application to a notary for the certification of the founding documents and their further submission to the Legal Entity Registration Center. Registration by notarial means is often used to establish a company where notarization of signatures or documents is required, such as when incorporating real estate or securities into the share capital.

Electronic Registration

Lithuania offers the possibility of electronic company registration via the Internet, which is a fast and convenient way for entrepreneurs. Electronic registration requires the use of a qualified electronic signature, which allows signing documents online. This method is available for both limited liability companies (UABs) and sole proprietorships.

Registered through an investment institution

Foreign investors can use the services of investment agencies or consulting firms, which provide a complete package of services for setting up a company, including preparation of necessary documents, legal support, assistance in opening bank accounts, and advice on tax planning.

Buy an existing company

Purchasing a ready-made company is another way to start a business in Lithuania. A ready-made company is already registered, which enables you to start business operations as quickly as possible without having to pay the authorized capital of the Lithuanian company to the new owner.

Conclusion

The choice of the method of company registration in Lithuania depends on many factors, including the specifics of the business, the requirements for founding documents, the need for notarization, and the entrepreneur's preference for the speed and convenience of the registration process. Whichever method is chosen, it is important to be fully prepared for the registration process, comply with Lithuanian law, and seek professional help when necessary. Establishing a company in Lithuania offers businesses access to a dynamically developing economy and provides them with extensive access to European markets.

Is it necessary to have a legal address in Lithuania?

Under Lithuanian law, every company registered in the country must have a legal address in Lithuania. This address is entered into the official register and used as the company's official place of registration. The legal address is necessary for correspondence with state agencies, tax authorities, and for keeping official documents.

Functional value

A legal address has several key functions:

Legal Representative: It serves as the official location for receiving all legal related notices and documents from public authorities, courts and third parties.

Tax Registration: In order to register with the tax authorities and obtain a TIN, a company must provide a registered address.

Business reputation: Having a registered office in a particular community can affect how your company is perceived by partners and customers.

How to provide a registered office

There are several ways to ensure you have a legal address in Lithuania:

Renting an office: One of the most obvious ways is to rent a commercial property to use as an office and registered office.

Virtual Office: For companies that don’t need a physical office space, a virtual office can be an affordable and convenient solution. A virtual office provides a legal address and often additional services, such as postal services.

Using legal and consulting services: Some legal and consulting firms offer services to provide a legal address for client companies.

Conclusion

Having a legal address in Lithuania is a prerequisite for establishing and further operating a business. It plays a central role in the company's legal representation, tax registration and business reputation formation. The method of choosing to secure a legal address depends on the specific circumstances and needs of the business, as well as the company's financial capabilities. Correctly choosing a legal address can greatly simplify the process of registration and subsequent operation of a Lithuanian company.

Is it possible to open a branch of a foreign company in Lithuania?

Lithuania is an attractive country for international companies seeking to expand their presence in the European market due to its strategic location in Europe, attractive tax system and friendly business environment. One way for foreign companies to start operations in Lithuania is to open a branch. Let's look at the main aspects of setting up a branch of a foreign company in Lithuania.

Understanding Branches

A branch of a foreign company in Lithuania is not considered an independent legal entity, but a part of the foreign company. This means that the foreign company is fully responsible for the activities of its branch in Lithuania.

Advantages of opening a branch office

Entry into European markets: A branch office enables foreign companies to quickly enter Lithuania and, by extension, the European market.

Reputation: Opening a branch in Lithuania can improve the company's credibility among local customers and partners.

Tax incentives: Lithuania offers a number of tax incentives to foreign investors, which may also apply to branches.

Steps to Opening a Branch Office

Document preparation: To register a branch, it is necessary to prepare and translate the foreign company's founding documents and the decision on establishing the branch into Lithuanian.

Registration with the Registry: The branch must be registered with the Lithuanian Business Register. The registration process includes submitting an application and related documents, as well as paying state taxes.

Appointment of an authorized representative: A foreign company must appoint an authorized representative in Lithuania to act on behalf of the branch.

Opening a bank account: The branch needs to open a bank account in a Lithuanian bank to conduct financial transactions.

Obtain necessary permits and licenses: Depending on the scope of the branch's activities, additional permits and licenses may be required.

Taxation of branches

A branch of a foreign company is taxed at the standard rate on profits earned in Lithuania. It is important to take into account the tax treaty between the country where the foreign company is domiciled and Lithuania to avoid double taxation.

Conclusion

Setting up a branch in Lithuania can be an effective way for a foreign company to start operating in the Lithuanian market, while providing access to a wide range of European markets. It is important to prepare carefully for the registration process, be aware of the Lithuanian legislation, and seek the help of professional advisors when necessary to ensure a successful opening and operation of a branch in Lithuania.

Can foreigners open a company in Lithuania?

In order to become one of the main business centers in Europe, Lithuania actively attracts foreign investors and entrepreneurs. The country offers a good economic environment, attractive tax conditions and simplified procedures for starting and running a business. But the question is: can foreign citizens open a company in Lithuania? The answer is yes, and in this article, we will describe the key aspects and steps required to achieve this task.

Legal aspects

Foreign citizens can open a company in Lithuania under the same conditions as locals. Lithuanian law does not distinguish between Lithuanian and foreign entrepreneurs in matters of registering and running a company. This means that a foreigner can be the sole founder (owner) of a company or one of several founders.

Company form selection

In Lithuania, the most popular company forms for foreign investors include:

Limited Liability Company (UAB): For small and medium-sized enterprises, the minimum authorized capital is EUR 2,500.

Stock Company (AB): Suitable for large companies with a large number of shareholders. The minimum authorized capital is EUR 40,000.

Company Registration

The process of registering a company for foreigners includes the following steps:

Choose a company name: You need to make sure that the name you choose is not already used by another registered company in Lithuania.

Prepare founding documents: including Articles of Incorporation and Memorandum of Incorporation.

Open a bank account: for depositing authorized capital.

Register at the Business Registration Center: Submit the required documents and pay the registration fee.

Obtain a tax registration number and register with the tax authority.

Required files

To register a company in Lithuania, foreign citizens need the following documents:

Passport or other identification document.

Document proving place of residence.

Translate incorporation documents into Lithuanian and notarize them.

Characteristics of foreigners

There are several specific aspects that foreign entrepreneurs must consider:

Visa requirements: Depending on your country of origin, you may need a visa or residence permit to run a company in Lithuania.

Accounting and Taxation: It is important to understand the accounting and taxation rules in Lithuania beforehand.

Conclusion

Opening a company in Lithuania by a foreign citizen is a fairly simple process, but it still requires thorough preparation and knowledge of Lithuanian laws. Due to the attractive business environment, many foreign entrepreneurs choose Lithuania as a platform for expanding their business. It is important to plan your actions in advance and, if necessary, seek help from professional legal and accounting advisors.

Is it possible to obtain a residence permit by opening a company in Lithuania?

As a member of the European Union, Lithuania offers unique business opportunities to foreign entrepreneurs while also being able to obtain a residence permit (residence permit). Incorporating a company in Lithuania can not only be a path to successfully conducting business, but also a means to secure legal residence in the country and gain the benefits of European residency. In this article, we will discuss the key aspects of obtaining a residence permit by incorporating a company in Lithuania.

Basic Terms and Conditions

Lithuanian law provides that foreign citizens can obtain a residence permit by establishing a company in Lithuania or investing in an existing business. In order to obtain a residence permit, the entrepreneur must meet the following conditions:

Establishing or acquiring a company in Lithuania.

Investment: The minimum investment amount of the company's authorized capital must meet the statutory standards.

Job creation: The company must create a certain number of jobs for Lithuanian citizens or EU residents.

Proof of financial soundness: The entrepreneur must prove that he or she can support himself or herself and his or her family in Lithuania.

Process of applying for a residence permit

Company Registration: The first step is to establish or acquire a company in Lithuania and meet all the requirements for starting a business.

Prepare documents: The next step is to prepare and submit a set of documents proving that you meet all the requirements for obtaining a residence permit.

Submitting the application: The application for a residence permit must be submitted to the Lithuanian Immigration Services in person or through a representative.

Application Processing: The time it takes to process an application can vary, but is usually between a few weeks to a few months.

Advantages of obtaining a residence permit in Lithuania

Obtaining a residence permit in Lithuania provides many opportunities for foreign entrepreneurs:

Free movement in the Schengen area: Holders of a residence permit have the right to move and stay freely in the Schengen area.

Access to Education and Healthcare: Residence permit holders have equal access to education and healthcare services as Lithuanian citizens.

Opportunity for family reunification: Entrepreneurs can bring their families to Lithuania by applying for residence permits for family members.

Conclusion

Establishing a company in Lithuania and subsequently obtaining a residence permit is a favorable solution for foreign investors who want to expand their business in Europe and ensure a stable future. It is important to prepare for the process thoroughly, carefully study all requirements and, if necessary, seek help from immigration law and business consulting experts at to ensure successful acquisition of a residence permit in Lithuania.

What is stipulated in the Articles of Association of a company registered in Lithuania?

The Articles of Association of a company are the main document that defines the legal status, structure, management and basic principles of a legal entity. In Lithuania, as in many other countries, the Articles of Association play a vital role in the life of a company from the moment it is established. In this article, we will look in more detail at what is usually stipulated in the Articles of Association of a company registered in Lithuania and why each of these points is important.

Name and legal address of your company

The Articles of Association must clearly state the company's full name and the location of its registered office in Lithuania. The legal address is necessary for official correspondence and is the place where the company is established.

Activity objectives and scope

The Articles of Association should indicate the company's main objectives and the types of economic activities it can engage in. This helps determine the company's direction and provides a legal basis for its business operations.

Amount and method of formation of authorized capital

The Articles of Association must contain information on the amount of authorized capital, as well as the procedure and term of its formation. In Lithuania, the minimum amount of authorized capital may vary depending on the type of legal entity.

Shareholder or founder information

The Articles of Association must contain information about the persons establishing the company, their shares in the share capital, and the rights conferred by those shares.

Company Management Structure

A very important part of the Articles of Association describes the company's governance structure, including the management bodies (e.g. shareholders' meeting, board of directors), their powers, decision-making and meeting procedures.

Procedure for amending the Articles of Association

The articles of incorporation should clearly define the amendment process, which is essential for the company to adapt to changing business conditions.

Reorganization and liquidation of companies

The articles of association should set out the conditions and procedures for the reorganization or liquidation of the company, including the distribution of assets in the event of liquidation.

Company Responsibility

The articles of association should set out the basis for the company's liability to its shareholders, creditors and other stakeholders.

Additional Terms and Conditions

The articles of association may also include other provisions appropriate to the specific nature of the company's business, such as those relating to profit distribution, records and reporting.

Conclusion

Articles of Association are the basic document of any registered company in Lithuania. Not only does it define the legal framework of the company's activities, but it also serves as the basis for the company's internal organization and management. Drafting Articles of Association requires careful consideration of all aspects of the company's future activities.

How long does it take to set up a company in Lithuania?

Due to its friendly business environment, strategic location and attractive tax regime, setting up a company in Lithuania is an attractive option for many foreign investors and entrepreneurs. However, when planning to start a business, a key issue is the time required to register a company. In this article, we will detail the time frame for setting up a company in Lithuania so that entrepreneurs can plan effectively.

Step 1: Prepare and submit documents

The first step involves preparing the necessary documents such as the Articles of Association (or Founders' Resolution), Bylaws, proof of payment of share capital and details of directors and founders. The time required for this step may vary depending on the complexity of the documents to be prepared and the availability of all the necessary information. On average, it may take anywhere from a few days to a few weeks to prepare the documents.

Step 2: Register at the Enterprise Registration Center

After preparing and collecting all the necessary documents, the next step is to submit them to the Lithuanian Business Registry. In recent years, Lithuania has significantly simplified and accelerated the company registration process, including the possibility of submitting documents electronically. The time required to register a company may take 1 to 3 working days for electronic submission and up to 5 working days for paper submission.

Step 3: Get the registration files and other programs

After the company is registered, the Corporate Registry will issue a certificate of registration, articles of incorporation with a registration stamp, and an extract from the registry. The company will then need to open a bank account and register with the tax authorities. These procedures may take an additional few days to a week.

Step 4: Tax Registration and Obtaining a TIN

The final step is to register with the Lithuanian Tax Office and obtain an Individual Tax Number (INN) for the company. This process usually takes up to 5 working days after submitting the relevant documents.

Conclusion

In general, setting up a company in Lithuania can take from one to several weeks, depending on specific circumstances such as the complexity of document preparation, the chosen submission format (electronic or paper), and the timeliness of additional procedures, such as opening a bank account and registering with the tax authorities. Due to the Lithuanian government's efforts to simplify and speed up the business registration process, Lithuania is an attractive jurisdiction for foreign investors looking to start or expand their business in Europe.

What activities can a company engage in in Lithuania?

Lithuania is a country with a developed economy and a favorable business climate, offering a wide range of opportunities for entrepreneurs and investors. Joining the European Union has opened up new horizons for Lithuania, making it an ideal location for launching and developing various business projects. In this article, we will discuss what activities a company can engage in in Lithuania, emphasizing the flexibility and diversity of opportunities offered by the Lithuanian legislation and economy.

IT and Startups

Lithuania is actively developing its information technology industry and becoming one of the leading centers of startup culture in Europe. The government offers various support programs, tax incentives and simplified registration procedures for IT companies and startups. This makes Lithuania an ideal place for software development, fintech projects, crypto companies, gaming and other innovative products.

Manufacturing and Industrial

Lithuania's manufacturing sector includes mechanical engineering, chemicals, electronics and food production. Thanks to a skilled workforce and developed infrastructure, foreign companies can efficiently organize production in Lithuania, both for the domestic market and for export to EU countries and other regions.

Trade and Export

Lithuania is strategically located as an important transport and logistics hub in the Baltic region. This creates favorable conditions for trading companies specializing in importing and exporting goods. Agricultural products, textiles, furniture and building materials are some of the goods that are successfully exported through Lithuania.

Service industry

Lithuania's service sector also offers a wide range of business opportunities, including tourism, education, healthcare, finance and consulting services. The tourism sector is particularly promising due to Lithuania's rich cultural heritage, beautiful natural scenery and developed tourist infrastructure.

Agriculture

Lithuania has traditionally been strong in the agricultural sector, providing opportunities for the development of both traditional agriculture and innovative agricultural technology projects. Organic farming, cereal cultivation, dairy production and animal husbandry are important investment areas.

Conclusion

Lithuania offers a wide range of business opportunities for foreign investors and entrepreneurs in various economic sectors. Flexible legislation, state support, strategic location and access to EU markets make Lithuania one of the most attractive countries to establish and grow a company. The key is to thoroughly research the market and choose the business sector that best suits your skills, interests and business goals.

Are employees required for a Lithuanian company?

In general, Lithuanian law does not set strict requirements on the minimum number of employees that a company must employ. This means that in theory, a company can operate without employing employees, relying on the services of its founders, directors or third-party contractors, but at least the company must have one employee to be registered with SODRA and pay monthly social taxes.

Exceptions and special requirements

However, in certain situations and activities, the presence of employees becomes a prerequisite:

Activities requiring a license: Some activities that require a special license (e.g., financial services, health services, construction) may include requirements for qualifications and number of employees.

State-supported projects: Companies participating in state-supported projects or receiving investment incentives are usually required to create new jobs and employ a certain number of employees.

Labor law regulations: It is important to remember that if a company employs workers, it is obliged to comply with Lithuanian labor law, including working conditions, minimum wages and social insurance.

Advantages of Hiring Employees

While there is no strict headcount requirement, hiring employees can provide a number of benefits to a company, including:

Business Growth: Skilled employees can contribute to the growth and development of a company by coming up with new ideas and improving the quality of products or services.

Flexibility in resource management: Employment enables companies to manage their employees more flexibly and adapt to changes in demand and workload.

Increased trust from customers and partners: Companies with full-time employees are generally viewed as more reliable and stable.

Conclusion

In Lithuania, a company can operate without employees if it does not violate the business characteristics and legal requirements. However, when deciding on the company's structure and resources, it is important to consider both legislative aspects and the strategic goals of the business. In some cases, hiring qualified employees may be the key to the company's success and long-term development in the Lithuanian market.

How to choose a name for a Lithuanian company?

Choosing a company name is not only a branding issue, but also an important legal aspect that can greatly affect the success and legality of your business in Lithuania. Lithuanian law sets certain requirements and restrictions when choosing a company name, which are intended to prevent confusion and ensure clarity in the business environment. In this article, we provide key advice on choosing a Lithuanian company name to ensure that it is easily recognizable and meets legal requirements.

Explore uniqueness

The first and most important step is to make sure that the name you choose is unique. In Lithuania, you cannot register a company with a name that is already used by another company or is too similar to an existing name. Using the services of the Lithuanian Legal Entity Center will allow you to check if the name you choose is already registered.

Relevance of company activities

A good name reflects the scope of your company and makes it clear to potential customers. However, avoid overly general or vague terms that may confuse consumers about what your company does.

Consider language

When choosing a name, it is important to take into account the linguistic and cultural peculiarities of Lithuania. If the main sales market is Lithuania, then the name should be easy to pronounce and remember. However, for companies targeting international markets, it is recommended to choose a name that is also easy to understand in other languages.

Avoid restricted and banned words

Certain words and phrases may be restricted from use in a company name without specific authorization. These words typically include names that indicate government activity or control, such as "country," "government," and words that require a license for a specific activity, such as "bank."

Check domain availability

In today’s world, having a website is a necessary part of doing business. Therefore, it is advisable to check if your business name has a proper domain name on the internet to ensure that your brand is consistent both online and offline.

Consult a professional

When choosing a Lithuanian company name, it may be useful to consult a legal advisor or branding expert who can help you not only meet all legal requirements but also create an attractive and memorable name for your business.

Conclusion

Choosing a company name in Lithuania requires careful consideration and consideration of many factors, from uniqueness and ease of pronunciation to compliance with legal requirements and availability of domain names. The right name will not only simplify the company registration process, but will also create a positive image and recognition in the market.

Business registration in Lithuania

The Lithuanian Commercial Register (Registrų centras) is a key component of the country's legal infrastructure, providing comprehensive information on companies registered in the country. The register not only promotes transparency and accessibility of information about business entities to state agencies, investors and ordinary citizens, but also provides a legal basis for conducting business activities in Lithuania. In this article, we will take a closer look at the functions of the Lithuanian Commercial Register, the registration procedure and its importance for business activities in Lithuania.

Business registration features

Business registration in Lithuania has some important functions:

Company Registration: This is a formal process that provides a company with the legal basis to begin operations.

Information storage: The register contains information about legal persons, including their name, registered office, information about directors and founders, as well as their financial status and history of changes.

Ensuring access to information: Information in the commercial register is open to the public, which promotes transparency in business and enables checks before a deal is concluded or a collaboration begins.

Registration process

In order to register a company in Lithuania, the following steps must be completed:

Preparing documents: The company's constituent documents must be carefully prepared in accordance with the requirements of Lithuanian law.

Submitting the application: The documents can be submitted online or directly at the registered office.

Payment of state taxes: The amount of the fee depends on the form of legal entity and the method of document submission.

Getting the Certificate of Registration: After reviewing the submitted documents, the company will be officially registered and receive a Certificate of Registration.

Commercial value

Business registration plays a key role in Lithuania's economic environment:

Legal transparency: Registries provide visibility into legal structures and their activities, promoting fair competition and preventing fraud.

Investor Confidence: The availability of information about a company increases the confidence of investors and partners as they can easily verify the financial standing and legal cleanliness of potential partners.

Simplified administrative procedures: The digitization of the business register and the possibility of online registration significantly simplify and speed up the process of starting and managing a business in Lithuania.

Conclusion

Lithuania's Business Register is an essential tool for creating and maintaining a healthy business ecosystem. It not only simplifies the company registration process and provides important legal information, but also promotes the development of a transparent and open business environment. Understanding the Business Register's operating principles and the opportunities it provides is a key factor in successfully doing business in Lithuania.